A bat made its way into a woman's oral cavity in Arizona, leading to approximately $21,000 in medical expenses for the unfortunate incident.

Erica Kahn, a 33-year-old former biomedical engineer from Massachusetts, is still grappling with the financial repercussions of a bat incident during a vacation in Northern Arizona. The incident occurred in August while Kahn was taking pictures of the night sky.

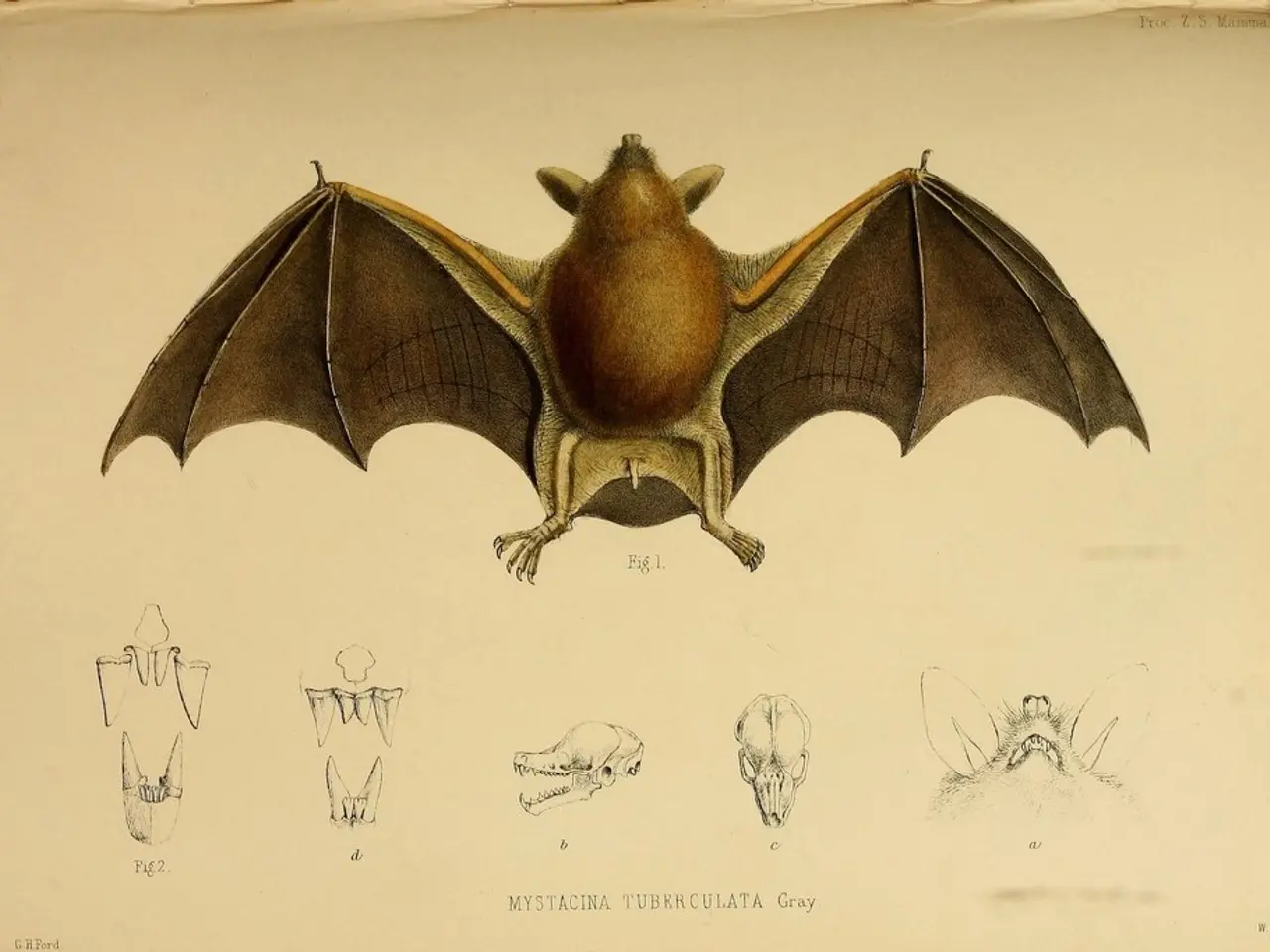

Kahn was bitten by a bat that got tangled between her face and camera, entering her mouth. While there are effective drugs for rabies, it can be fatal if not treated before symptoms appear. Kahn sought medical care for rabies at the urging of her travel partner and father, a doctor.

However, Kahn had declined to pay for her former employer's insurance through COBRA, as she believed she could afford private insurance if needed. Unfortunately, most private health insurance plans in the U.S. do not kick in immediately after enrollment, generally starting on the first of the month after enrollment. Kahn bought a private health insurance policy online before receiving rabies vaccinations and treatment, but it had a 30-day waiting period, resulting in $20,749 in medical bills.

Kahn's story may inspire others to secure health insurance promptly to avoid similar financial burdens. Sabrina Corlette, co-director of the Center on Health Insurance Reforms at Georgetown University, stated that insurance companies do not want people to wait to sign up for coverage until they are sick.

The delay between job loss and COBRA coverage activation can leave individuals exposed to high out-of-pocket expenses for urgent medical care. Kahn regrets not securing private health insurance as soon as she was laid off and believes she should have used COBRA, despite its expense.

The cost of COBRA was a factor in Kahn's decision not to use it after being laid off. While COBRA coverage allows individuals who lose employer-sponsored health insurance due to job loss or reduction in hours to continue the same group health plan for a limited time, it is often expensive because beneficiaries must pay the full premium plus up to a 2% administrative fee.

Additionally, COBRA coverage is not considered "creditable coverage" for Medicare Part B enrollment rules, meaning delays in signing up for Medicare Part B while relying on COBRA can lead to permanent premium penalties and coverage gaps.

In conclusion, the incident experienced by Erica Kahn serves as a reminder for the importance of prompt action after job loss to elect COBRA coverage within the legal timeframe. Delaying coverage can lead to substantial medical debt during periods of uninsured risk, as demonstrated by Kahn's case.

- Erica Kahn, a former biomedical engineer, encountered financial difficulties following a bat incident during a vacation.

- Kahn was bitten by a bat while taking pictures of the night sky in August, resulting in medical bills due to rabies treatment.

- Kahn declined her former employer's insurance through COBRA, preferring private insurance, but found herself with outstanding medical bills due to a 30-day waiting period.

- Sabrina Corlette, from Georgetown University, emphasizes the importance of signing up for health insurance promptly to avoid financial burdens like Kahn's.

- Insurance companies encourage continuous coverage to prevent delayed sign-ups when individuals are already sick.

- The delay between job loss and COBRA coverage activation leaves individuals vulnerable to high out-of-pocket expenses for urgent medical care.

- Kahn regrets not securing private health insurance immediately after being laid off and thinks she should have used COBRA, despite its high cost.

- The cost of COBRA coverage is often expensive, as beneficiaries must pay the full premium plus up to a 2% administrative fee.

- COBRA coverage is not considered "creditable coverage" for Medicare Part B enrollment rules, potentially leading to permanent premium penalties and coverage gaps.

- Erica Kahn's case highlights the significance of prompt action after job loss to elect COBRA coverage within the legal timeframe.

- Failure to take action can lead to substantial medical debt during periods of uninsured risk.

- Wealth management and personal finance experts recommend budgeting, saving, and debt management to cover such unexpected expenses.

- Kahn's story demonstrates the impact of chronic diseases and medical conditions on one's finances, emphasizing the need for comprehensive insurance coverage.

- Mental health, fitness, and wellness programs may help manage stress and anxiety caused by financial hardship due to medical conditions or accidents.

- Individuals should consider career development, learning new skills, and education for self-development to secure better financial stability in the future.